Bajaj Finserv Ltd, the financial services arm of Bajaj Holdings and Investments Ltd, has announced its decision to acquire Allianz SE’s 26% stake in Bajaj Allianz Life Insurance and Bajaj Allianz General Insurance for a total of ₹24,180 crore. This buyout will mark one of the largest transactions in India’s insurance sector history, giving Bajaj Finserv greater control over its insurance ventures.

Details of the Bajaj-Allianz Buyout

- Current Ownership: Bajaj Finserv holds 74%, while Allianz SE owns 26% in both insurance companies.

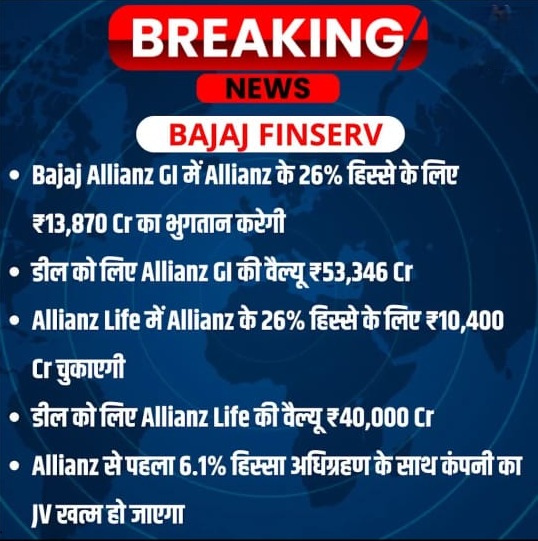

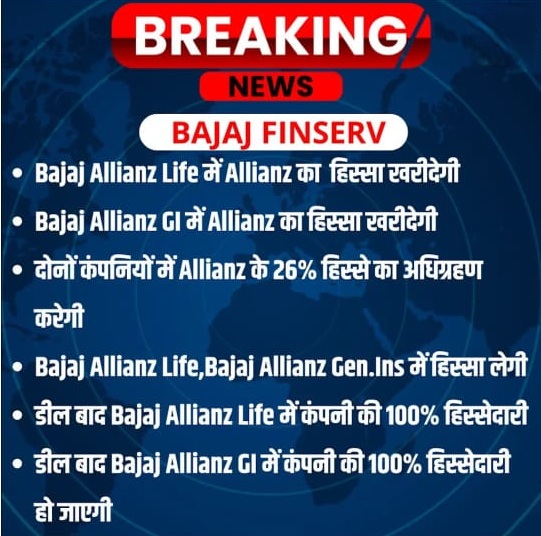

- Stake Acquisition: Bajaj Finserv will acquire Allianz’s entire 26% stake in both companies.

- Breakdown of Acquisition:

- Bajaj Finserv: 1.01%

- Bajaj Holdings & Investment: 19.95%

- Jamnalal Sons: 5.04%

- Post-Transaction Stake: Bajaj Finserv’s ownership will rise to 75.01% in both insurance ventures.

- Total Transaction Value: ₹24,180 crore

Why Did Allianz Exit?

Allianz had been in discussions with Bajaj to increase its stake to 49% after the Indian government raised the foreign direct investment (FDI) limit in insurance from 26% to 49% in 2015. However, due to disagreements over valuation, the deal never materialized. Instead, Allianz decided to exit the joint venture and focus on independent expansion in India’s insurance sector.

Impact of the Buyout on the Indian Insurance Industry

This deal has significant implications for India’s insurance landscape:

- End of a 24-Year-Old JV: The long-standing joint venture between Bajaj and Allianz will be officially terminated post-acquisition.

- Largest Insurance Buyout in India: The deal sets a new benchmark in the financial sector.

- Single Ownership Advantage: Bajaj Finserv will now have full strategic control over its insurance businesses.

- Smooth Transition Plan: Both companies have committed to ensuring a seamless transition for policyholders and intermediaries.

Sanjiv Bajaj’s Statement on the Acquisition

Sanjiv Bajaj, Chairman & MD of Bajaj Finserv, stated:

“Together with Allianz, we have built two of the strongest insurance companies in India, with a combined premium exceeding ₹40,000 crore. Given the advantage of single ownership in both companies, we are confident that the acquisition will become a big driver of value for our stakeholders in the years to come.”

Next Steps for Bajaj Finserv & Allianz

- Reclassification of Allianz’s Stake: Allianz SE will no longer be a promoter but will be classified as an investor once the first tranche of acquisition (at least 6.1%) is completed.

- Independent Strategies: Both Bajaj Finserv and Allianz will pursue independent expansion strategies in the Indian insurance market.

- Continuity of Services: Bajaj and Allianz have agreed to continue reinsurance and other services during the transition to minimize any disruptions.

Conclusion

Bajaj Finserv’s acquisition of Allianz’s stake in its insurance ventures is a landmark deal, reinforcing India’s growing insurance sector. With single ownership, Bajaj Finserv aims to drive innovation, expand market reach, and enhance customer experience. Meanwhile, Allianz’s exit signals its intent to pursue standalone opportunities in India’s fast-evolving financial landscape.

Stay tuned for further updates on Bajaj Finserv’s future plans and India’s insurance sector developments!