India’s second-largest private lender, ICICI Bank, has announced impressive financial results for the fourth quarter of FY25, highlighting its steady growth trajectory and strong financial fundamentals.

Net Profit Beats Street Estimates

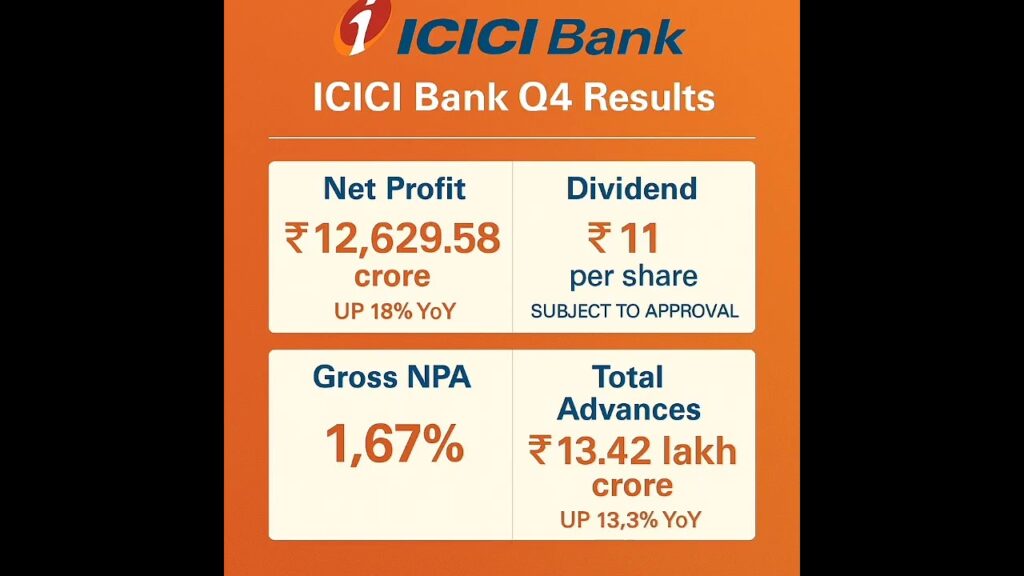

ICICI Bank reported a standalone net profit of ₹12,629.58 crore, marking an 18% year-on-year (YoY) increase, surpassing analyst expectations of ₹12,050 crore. On a sequential basis, profit rose 7.1%, reflecting the bank’s consistent performance despite a dynamic economic environment.

Net Interest Income and Margins Improve

The bank’s Net Interest Income (NII) jumped 11% YoY to ₹21,193 crore, compared to ₹19,093 crore in Q4FY24.

The Net Interest Margin (NIM) stood at 4.41% in Q4FY25, up from 4.25% in the previous quarter and 4.40% in the same quarter last year.

Asset Quality Strengthens

ICICI Bank made significant improvements in asset quality:

- Gross NPA declined to 1.67% as of March 31, 2025, from 1.96% in Q3FY25 and 2.16% a year ago.

- Net NPA stood at 0.39%, improving from 0.42% in the previous quarter.

Deposits and Advances Show Steady Growth

The bank’s total deposits rose 14% YoY and 5.9% sequentially to reach ₹16.11 lakh crore by the end of March 2025.

- Average current account deposits increased 9.6% YoY.

- Average savings account deposits grew 10.1% YoY.

Meanwhile, total advances climbed 13.3% YoY to ₹13.42 lakh crore, with key highlights:

- Retail loans grew by 8.9% YoY

- Business banking portfolio surged 33.7% YoY

- Rural loans saw a modest 5.1% YoY increase

- Corporate portfolio grew 11.9% YoY

Dividend Announcement

The Board of ICICI Bank recommended a dividend of ₹11 per share (face value ₹2), subject to approval at the Annual General Meeting (AGM). This move signals the bank’s confidence in its financial position and its commitment to shareholder value.

Expanding Network

With the addition of 241 new branches in Q4, ICICI Bank’s network now includes 6,983 branches and 16,285 ATMs and cash recycling machines, strengthening its nationwide reach.

Conclusion

ICICI Bank’s Q4FY25 performance highlights robust profitability, improved asset quality, and healthy growth in both deposits and advances. The strong showing positions the bank favorably for FY26 and reflects its strategic focus on retail, business banking, and technology-led expansion.

Stay tuned for more updates on ICICI Bank and other key financial players in India’s rapidly evolving banking landscape.