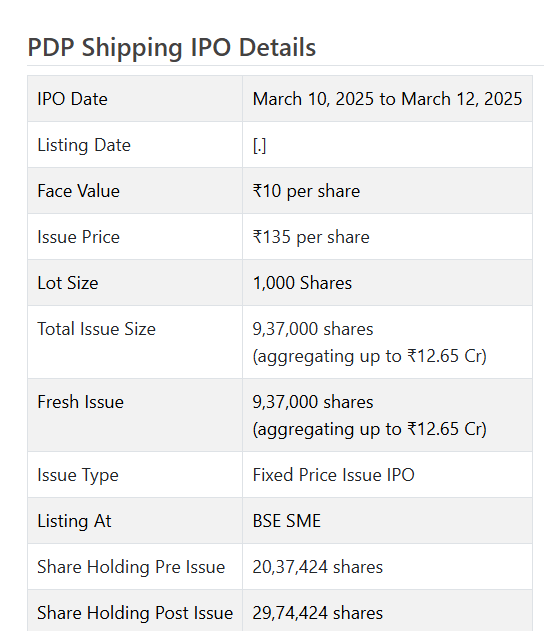

The PDP Shipping IPO had been opened for subscription on March 10, 2025, and is scheduled to close today, March 12, 2025. A price band of ₹135 per share had been set. As of Day 3, 76% of the total shares have been subscribed, with the retail portion oversubscribed at 1.39 times. The IPO has aimed to raise ₹12.65 crore.

About PDP Shipping & Projects Limited

Established in 2009, PDP Shipping & Projects Limited specializes in providing end-to-end logistics solutions, including sea/air freight, customs clearance, and project logistics. The company has been designated as an Authorized Economic Operator (AEO), facilitating global cargo transportation via sea, air, road, rail, and multi-modal networks.

The company has adopted an asset-light model, wherein partnerships with third-party operators have been established to deliver cost-effective and high-quality services. The logistics solutions provided are focused on specialized cargo such as machinery, defense equipment, and automobiles across markets including Brazil, the USA, and South Korea.

Business Model:

- Multimodal Transport Operations (MTO): A Multi-Modal Transport Operator’s License has been acquired by the company, allowing for flexible transportation through rail, road, and air. Services such as FCL, LCL, customs clearance, warehousing, and door delivery have been offered to ensure smooth and timely deliveries worldwide.

- Air Freight: Long-term relationships with global airline carriers have been developed, securing competitive rates, reliable transit times, and cargo allocations.

- Ocean Freight: Freight shipping by sea has been coordinated by the company, which provides LCL, FCL, cargo consolidation, customs clearance, packing, delivery, documentation, and temperature-sensitive cargo handling.

- Packaging, Warehousing, Transportation & Distribution: Services such as packaging, warehousing, transportation, and distribution have been provided, including third-party solutions that ensure safe packaging, storage, timely delivery, inventory management, and last-mile efficiency for both domestic and international shipments.

As of January 27, 2025, 18 employees have been employed by the company.

Competitive Strengths:

- Integrated, end-to-end logistics services and solutions have been offered.

- A large existing network has been developed.

- The senior management team possesses strong industry knowledge and expertise.

- Established client relationships have been maintained.

Company Financials

PDP Shipping & Projects Limited Financial Data (Restated)

| Period Ended | 30 Nov 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

|---|---|---|---|---|

| Assets | ₹12.32 Cr | ₹8.26 Cr | ₹6.22 Cr | ₹4.22 Cr |

| Revenue | ₹13.78 Cr | ₹20.58 Cr | ₹22.6 Cr | ₹28.73 Cr |

| Profit After Tax | ₹1.57 Cr | ₹2.31 Cr | ₹1.68 Cr | ₹1.91 Cr |

| Net Worth | ₹7.41 Cr | ₹5.84 Cr | ₹3.52 Cr | ₹1.85 Cr |

| Reserves and Surplus | ₹5.38 Cr | ₹3.81 Cr | ₹3.46 Cr | ₹1.78 Cr |

| Total Borrowing | ₹3.57 Cr | ₹0.5 Cr | ₹0.3 Cr | ₹0.04 Cr |

Key Performance Indicators (KPI)

As of March 31, 2023, the following KPIs have been reported:

| KPI | Values |

| ROE | 39.62% |

| ROCE | 50.04% |

| Debt/Equity | 0.09 |

| RoNW | 39.62% |

| PAT Margin | 7.48% |

| Price to Book Value | 4.71 |

The market capitalization of PDP Shipping IPO has been valued at ₹40.15 crore.

Conclusion

With its strong presence in the logistics and transportation sector, PDP Shipping & Projects Limited has demonstrated consistent growth in revenue and profitability. The IPO has received positive market reception, with a fully booked retail portion and a 76% overall subscription rate as of Day 3. Investors may find this IPO an attractive opportunity based on the company’s business model, financial stability, and strategic market positioning.